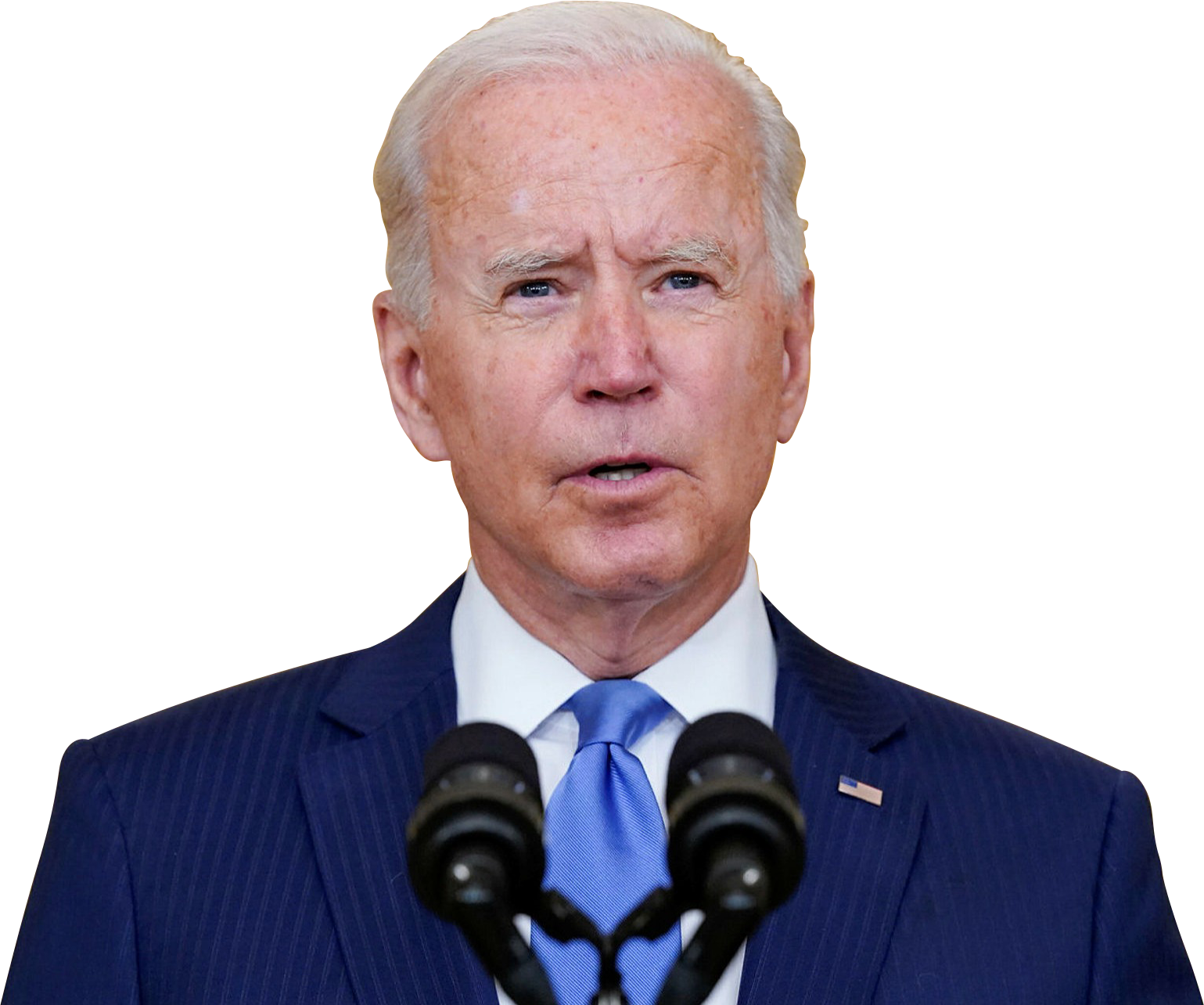

Biden Student Loan Forgiveness

In 2021, President Biden made a campaign promise to cancel up to $10,000 in student loans for borrowers. However, the Supreme Court struck down its plan in June 2023, ruling that the administration did not have the authority to cancel student loan debt under the HEROES Act.

Despite the Supreme Court ruling, the Biden administration continues to explore other avenues to cancel student loans and make it easier for borrowers to obtain loan forgiveness. In July 2023, the administration announced that it would forgive $39 billion in student loans for 804,000 borrowers. This loan forgiveness was the result of improvements to the student loan system’s income-driven repayment plans.

The Biden administration has also made it easier for borrowers to qualify for the Public Service Loan Forgiveness (PSLF) program. Under PSLF, borrowers can have their remaining student loans forgiven after making 120 qualifying payments while working full-time for an eligible public service employer. The Biden administration made several changes to the PSLF, including expanding the list of eligible employers and making past payments easier to count.

In addition to these specific initiatives, the Biden administration has also taken steps to address the broader issue of student loan debt. In April 2023, the administration announced a new plan to help borrowers manage their student loan debt. The plan includes several provisions, such as increasing the moratorium on student loan payments and providing borrowers with more flexibility in their repayment plans.

The Biden administration’s efforts to address student loan debt have received a mixed response. Some borrowers have praised the administration’s actions, while others have called for more aggressive student loan forgiveness. The future of student loan forgiveness is uncertain, but the Biden administration has made it clear that it is committed to finding ways to help borrowers relieve their debt burden.

What is Student Loan Forgiveness?

Student loan forgiveness is a government program that cancels all or part of a borrower’s student loans. There are several different student loan forgiveness programs, each with its own eligibility requirements.

Some of the most common Biden student loan forgiveness programs include:

- Public Service Loan Forgiveness (PSLF): This program forgives the balance on a borrower’s federal student loans after making 120 qualifying payments while working full-time for an eligible public service employer.

- Teacher Loan Forgiveness: This program forgives up to $17,500 in federal student loans for borrowers who teach full-time at low-income schools or educational service agencies.

- Disability Forgiveness: This program forgives the balance on a borrower’s federal student loans if they are permanently and totally disabled.

- Closed School Discharge: This program forgives the balance on a borrower’s federal student loan if they attended a school that closed while they were enrolled.

Who Qualifies for Biden Student Loan Forgiveness?

Eligibility requirements for student loan forgiveness vary by program. However, most programs require borrowers to meet the following criteria:

- Be in good standing with their loan servicer.

- Make all required payments on time.

- Work full-time for a qualifying employer.

- Have a qualifying disability.

- Have attended a closed school.

How to Apply for Student Loan Forgiveness

The application process for student loan forgiveness varies depending on the program. However, most programs require borrowers to submit an application to the Department of Education.

The application process can be long and complicated. However, the Department of Education has several resources available to help borrowers apply for student loan forgiveness.

The Future of Student Loan Forgiveness

The future of student loan forgiveness is uncertain. However, the Biden administration has made it clear that it is committed to finding ways to help borrowers relieve their debt burden.

The administration has already taken several steps to address student loan debt, and it is likely that they will continue to pursue the issue in the future. It remains to be seen what form student loan forgiveness will ultimately take, but the Biden administration has made it clear that they are committed to helping borrowers find relief from their student loan debt.

Conclusion

Biden Student loan forgiveness is a complex issue with a long history. The Biden administration has taken several steps to address student loan debt, and it is likely that the issue will remain a major focus of the administration for years to come. Only time will tell what the future holds for student loan forgiveness, but the Biden administration has made it clear that they are committed to helping borrowers find relief from their student loan debt.